In a recent debate with Michael Pento, an intriguing argument was made that increases in money supply, federal deficits, and quantitative easing (QE) would lead to 1970s-style inflation. This perspective seems reinforced by the inflation spikes observed in 2021 and 2022. However, historical data suggests that these factors do not necessarily correlate with inflationary trends. This article delves into the nuanced relationship between monetary policy, fiscal deficits, and inflation, revealing why today's economic environment is markedly different from the past.

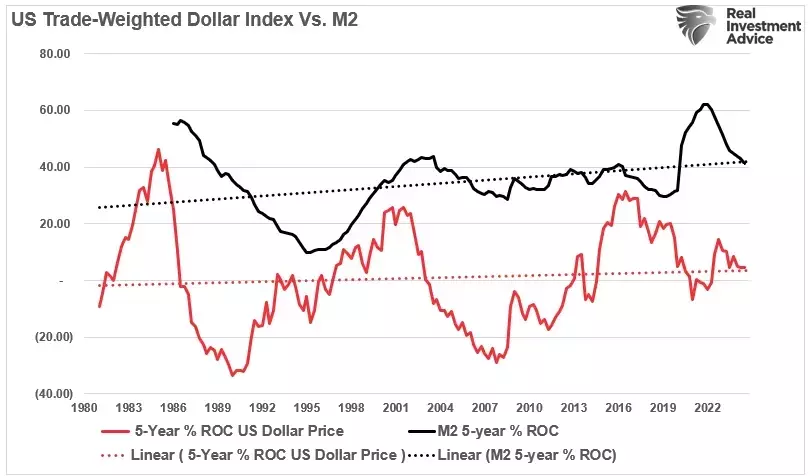

The misconception that rising money supply directly causes inflation stems from two flawed assumptions. First, it incorrectly assumes that the U.S. dollar has lost value relative to all other currencies due to increased money supply. Contrary to this belief, the trade-weighted value of the U.S. dollar has remained stable compared to its 1980 levels, despite significant growth in M2. In fact, increases in the rate of change of money supply have historically correlated with a stronger dollar, not a weaker one. Second, the argument overlooks the broader context of economic cycles. Historically, increases in the money supply have coincided with deflationary periods such as the Dot.com crash and the Financial Crisis, rather than causing inflation. Notably, the only exception was the unique circumstances of the COVID-19 pandemic, which temporarily disrupted supply-demand equilibrium.

The notion that government "money printing" leads to higher inflation is also a misinterpretation. In reality, all money is created through lending, not direct printing. When the government needs funds, it issues debt, which is purchased by primary dealers who provide capital. This process does not increase the money supply but rather shifts assets within the financial system. Consequently, the federal deficit, often cited as a cause of inflation, has had little impact on price levels. Since 1985, inflation has generally decreased while the federal deficit has grown, indicating that higher deficits are associated with slower economic activity and lower inflation. This inverse relationship underscores the deflationary nature of non-productive government spending.

Quantitative easing (QE) further complicates the inflation narrative. Contrary to popular belief, QE does not create new money but involves asset swaps between banks and the Federal Reserve. These swaps boost bank reserves without stimulating economic activity or increasing the money supply. As a result, despite multiple rounds of QE, inflation remained moderate around the Fed's 2% target until early 2020. The surge in inflation during 2020 was driven by extraordinary circumstances—specifically, the shutdown-induced supply constraints coupled with stimulus-driven demand surges. Once these temporary factors dissipated, inflation began to normalize.

Looking ahead, the long-term outlook points towards disinflation rather than renewed inflation. The ongoing accumulation of unproductive debt will likely exacerbate deflationary pressures and slow economic growth. Historical evidence shows that rising debt levels have consistently detracted from economic prosperity, necessitating continued government deficit spending to support social welfare systems. While another significant inflationary event cannot be ruled out, it would require a substantial disruption in supply and demand dynamics. For now, investors should remain vigilant about disinflationary risks, which can significantly impact earnings growth.

Italian Tennis Star Claims Back-to-Back Australian Open Titles

Jannik Sinner, the world's top men’s tennis player, secured his third Grand Slam title with a domi

Annual Food Distribution Event Unites Communities in Granger and Elkhart

The 22nd Annual Food Drop at Granger Community Church and Elkhart Campus on E. Bristol St. provided

Tragic Incident Claims Life of Infant in Jacksonville

In Jacksonville, Florida, an eight-month-old child died after being placed on the road and run over

Unveiling the Power of Growth Factors: A Revolutionary Skincare Breakthrough

The Ordinary, known for making innovative skincare ingredients accessible, has launched an affordabl

The Surprising Trend of Perfume Marinating: A Fragrant Experiment

While working at a department store during university, I learned that certain clothing items should

Unveiling the Artistry: A Deep Dive into Autumn/Winter Fashion Trends

This Autumn/Winter 2024 issue of AnOther Magazine showcases a striking fashion spread featuring a mo

Unwrap Style and Care: The Ultimate Holiday Gift Guide for 2024 and 2025

This holiday season, enhance your gift-giving with stylish and caring products. For beauty enthusias

Unveiling the Legacy: The Evolution of Grammy's Song of the Year

The Grammy Awards annually celebrate the music industry's elite through its "big four" categories: A

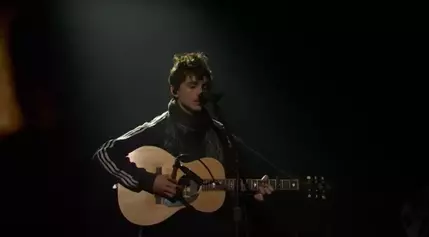

Chalamet's Musical Journey: A Night of Dylan Classics on SNL

Timothée Chalamet, starring in the 2024 Bob Dylan biopic *Complete Unknown*, hosted *Saturday Night

Entertainment Quirks Spark Viewer Discussions

This article discusses viewer reactions to unrealistic elements in TV shows, particularly legal and

Sony and Insomniac Games Eye PlayStation Franchises for Screen Adaptations

Sony is aggressively expanding its franchises, now shifting focus from live-action Spider-Man spin-o

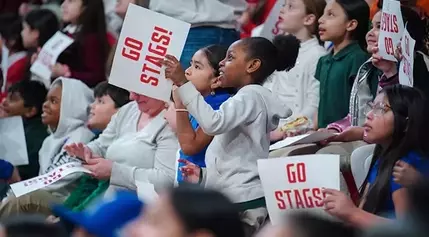

Fairfield Stags Triumph in Thrilling Kids' Day Out Game

Fairfield Women’s Basketball secured a 69-44 victory over Manhattan in their annual Kids’ Day Ou

Advancements in Biofuels Strengthen Food Security and Sustainability

The food versus fuel debate persists decades after the introduction of biofuels. Steve Reinhard, an

Community Unites Through Sweet Treats to Support Injured Kindergartner

Hurts Donut is supporting Bryson Gaspard, a Scott County Central kindergartner struck by a truck, by

Tragic Midnight Crash Claims Life in Plymouth

A fatal accident occurred shortly before midnight in Plymouth, Massachusetts, involving a wrong-way

Community Unites to Support Teen After Critical Car Accident

Tim Crader is grateful for the swift actions of a good Samaritan who helped save his 18-year-old son

Ford Initiates Major Recall for Bronco and Maverick Due to Battery Issues

Ford Motor is recalling 272,817 Bronco and Maverick vehicles from model years 2021-2023 due to poten

Bridgeport Teens Charged After Kidnapping and Vehicle Theft Incident

In Stratford, CT, two Bridgeport teens—a 17-year-old and a 13-year-old—were charged with kidnapp

Unveiling the Future of First-Person Shooters: The Evolution of Doom

The A.V. Club discusses the upcoming *Doom: The Dark Ages*, reflecting on a recent 11-minute preview

The Impact of Industry Challenges on Video Game Workforce

The video game industry has witnessed widespread layoffs, partly due to the "Pong Problem," a term r