In an era of economic uncertainty and shifting market dynamics, investors are seeking optimal ways to allocate their funds. This article explores strategies for managing large sums of money, evaluating fixed-income options, and understanding the intricacies of currency-hedged ETFs. The advice provided aims to help retirees and seasoned investors make informed decisions in a volatile financial landscape.

For individuals like Fred S., who have recently sold a property and are looking to invest the proceeds, it's crucial to adopt a cautious approach. With a substantial sum at hand, deciding between holding cash or investing in dividend ETFs requires careful consideration of market conditions and personal risk tolerance. Given the potential for market volatility, maintaining flexibility is key to making well-informed investment choices.

The current plan to hold half the funds in cash or similar instruments while investing the remainder in high-quality dividend ETFs is a prudent strategy. However, given the uncertain political climate and the potential impact of policy changes on Canadian stocks, it may be wise to delay major investment decisions until after receiving the funds in April. By then, market conditions might offer clearer insights, enabling more strategic allocation. Additionally, exploring diversified ETFs that span multiple regions can provide a buffer against regional economic fluctuations.

Larry H.'s query about enhancing fixed-income holdings reflects a growing trend among retirees to de-risk portfolios amid geopolitical uncertainties. Balancing short-term and long-term investments is essential for achieving stability and consistent returns. Evaluating various ETFs with attractive yields involves assessing both safety and performance history.

Among the options considered, CMR stands out due to its impressive yield. As an iShares Premium Money Market ETF, it invests in high-quality, short-term fixed-income securities, offering a secure investment vehicle. Despite its high yield, CMR has demonstrated resilience, not losing money since 2019. However, investors should temper expectations for future returns, as the fund's performance last year was influenced by unusual market conditions. For a balanced portfolio, Larry should decide whether to pursue a barbell strategy, focusing on extremes, or a middle-of-the-road approach, adjusting positions based on risk tolerance. XBB, being a core bond fund, may not align with a strict barbell strategy but could serve as a stable anchor in a diversified portfolio.

Italian Tennis Star Claims Back-to-Back Australian Open Titles

Jannik Sinner, the world's top men’s tennis player, secured his third Grand Slam title with a domi

Annual Food Distribution Event Unites Communities in Granger and Elkhart

The 22nd Annual Food Drop at Granger Community Church and Elkhart Campus on E. Bristol St. provided

Tragic Incident Claims Life of Infant in Jacksonville

In Jacksonville, Florida, an eight-month-old child died after being placed on the road and run over

Unveiling the Power of Growth Factors: A Revolutionary Skincare Breakthrough

The Ordinary, known for making innovative skincare ingredients accessible, has launched an affordabl

The Surprising Trend of Perfume Marinating: A Fragrant Experiment

While working at a department store during university, I learned that certain clothing items should

Unveiling the Artistry: A Deep Dive into Autumn/Winter Fashion Trends

This Autumn/Winter 2024 issue of AnOther Magazine showcases a striking fashion spread featuring a mo

Unwrap Style and Care: The Ultimate Holiday Gift Guide for 2024 and 2025

This holiday season, enhance your gift-giving with stylish and caring products. For beauty enthusias

Unveiling the Legacy: The Evolution of Grammy's Song of the Year

The Grammy Awards annually celebrate the music industry's elite through its "big four" categories: A

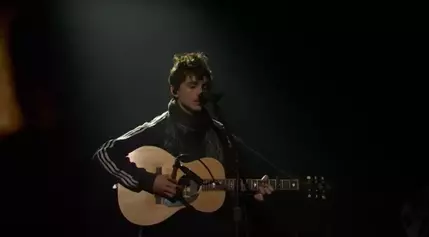

Chalamet's Musical Journey: A Night of Dylan Classics on SNL

Timothée Chalamet, starring in the 2024 Bob Dylan biopic *Complete Unknown*, hosted *Saturday Night

Entertainment Quirks Spark Viewer Discussions

This article discusses viewer reactions to unrealistic elements in TV shows, particularly legal and

Sony and Insomniac Games Eye PlayStation Franchises for Screen Adaptations

Sony is aggressively expanding its franchises, now shifting focus from live-action Spider-Man spin-o

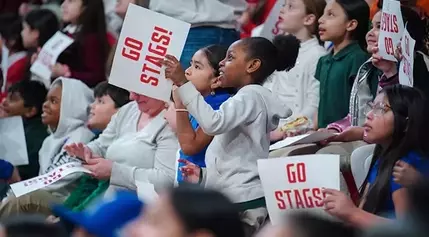

Fairfield Stags Triumph in Thrilling Kids' Day Out Game

Fairfield Women’s Basketball secured a 69-44 victory over Manhattan in their annual Kids’ Day Ou

Advancements in Biofuels Strengthen Food Security and Sustainability

The food versus fuel debate persists decades after the introduction of biofuels. Steve Reinhard, an

Community Unites Through Sweet Treats to Support Injured Kindergartner

Hurts Donut is supporting Bryson Gaspard, a Scott County Central kindergartner struck by a truck, by

Tragic Midnight Crash Claims Life in Plymouth

A fatal accident occurred shortly before midnight in Plymouth, Massachusetts, involving a wrong-way

Community Unites to Support Teen After Critical Car Accident

Tim Crader is grateful for the swift actions of a good Samaritan who helped save his 18-year-old son

Ford Initiates Major Recall for Bronco and Maverick Due to Battery Issues

Ford Motor is recalling 272,817 Bronco and Maverick vehicles from model years 2021-2023 due to poten

Bridgeport Teens Charged After Kidnapping and Vehicle Theft Incident

In Stratford, CT, two Bridgeport teens—a 17-year-old and a 13-year-old—were charged with kidnapp

Unveiling the Future of First-Person Shooters: The Evolution of Doom

The A.V. Club discusses the upcoming *Doom: The Dark Ages*, reflecting on a recent 11-minute preview

The Impact of Industry Challenges on Video Game Workforce

The video game industry has witnessed widespread layoffs, partly due to the "Pong Problem," a term r